richmond property tax rate 2021

Personal Property Taxes are billed once a year with a December 5 th due date. Ad Find Out the Market Value of Any Property and Past Sale Prices.

The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead.

. Over 4M 4 1000 of assessment value over 4M 0004 City of Richmond 2021 TAX RATES New Additional School Tax for Qualifying Residential Properties. Rockingham NC 28379 Business. School Boards - 23 per cent of property taxes.

Andy Beshear signed an executive order on Wednesday that will freeze the vehicle tax rate to the same rate owners paid in 2021. Property Taxes Due 2021 property tax bills were due as of November 15 2021. Car Tax Credit -PPTR.

Search Any Address 2. Richmond Hill - 27 per cent of property taxes. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February 28th.

Twenty-six counties had a revaluation in 2019 and 12 counties have one in 2020. Fifteen counties had a tax rate change in 2020-21 with four counties increasing and eleven counties decreasing their rate. Year Municipal Rate Educational Rate Final Tax Rate.

Vehicle License Tax Vehicles. 19-20 Tax Bills Personal Property 19-20 Tax Bills Real Estate G-O. Tax District 004 Blythe wfire.

19-20 Commitment Book Map and Lot 19-20 Personal Property by Name. How are residential property taxes divided. 2012 Tax Rates.

Tax District 002 County wfire 310460. 2 1000 of assmt value between 3M to 4M 0002 Tier 2. See Property Records Tax Titles Owner Info More.

The rates of several taxing authorities usually combine to make up your total tax bill. Between 3M to 4M. 19-20 Tax Bills Real Estate A-F 19-20 Tax Bills Real Estate P-Z.

The residential tax bill is divided as follows. PROPERTY TAX RATES The general portion is used for general government purposes the parks portion is used to fund the establishment and maintenance of free public parks in the City and the debt service portion is used to pay general obligation debt issued by the City. City property tax rates for 2021 per 100 assessed valuation.

Seasonalbeach property residential vacant land residential buildings on leased land residential condo time shared condo farmforestopen space mobile homes two-family owner occupied properties FY 2021 Rhode Island Tax Rates by Class of Property Tax Roll Year 2020 Represents tax rate per thousand dollars of assessed value. This year the city chose to select the compensating rate for the 2021 rates. Tax District 001 Urban 339240.

Property taxes are billed in October of each year but they do not. View more information about payment responsibility. 2010 Tax Rates.

Vehicle License Tax Motorcycles. Vehicle License Tax Antique. The rates will be adjusted for 163 cents on each 100 of personal property and 134 cents on each 100 worth of real.

Tax District 003 Hephzibah 290790. Macomb County Homestead Tax Rate Comparisons. Region of York - 50 per cent of property taxes.

Vagas Jackson Tax Administrator 1401 Fayetteville Rd. Learn all about Richmond real estate tax. 20-21 RE Tax Bills 20-21 PP Tax Bills.

Start Your Homeowner Search Today. Learn about Richmond Hills budget. For more information call 706-821-2391.

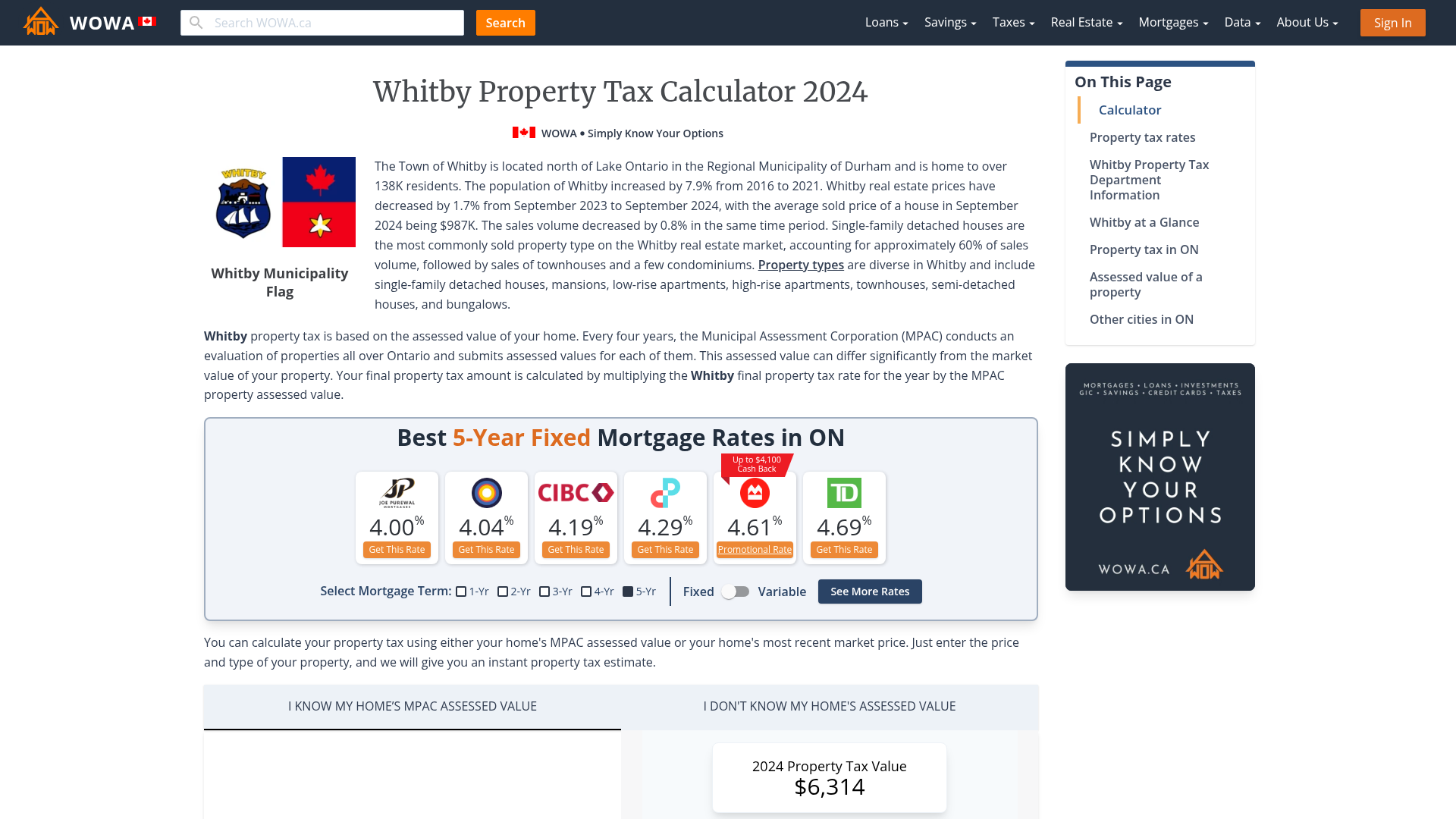

2021 Richmond Millage Rates To view previous years Millage Rates for the City of Richmond please click here. Residential Property Tax Rate for Richmond Hill from 2018 to 2021. Personal Property Registration Form.

Whether you are already a resident or just considering moving to Richmond to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Ad Get In-Depth Property Tax Data In Minutes. Richmond Hill accounts for only about a quarter of your tax bill.

Millage Rates 2021 Net Millage Rates are as follows. 352 rows 2021 Massachusetts Property Tax Rates Click here for a map with more tax rates Updated December 3 2021. For all who owned property on January 1 even if the property has been sold a tax bill will still be sent.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Beshear said the decision was made based on the rising rates of car values which rose by 40 last year. Payments cannot be taken at the tax commissioners tag offices.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. 19-20 Commitment Book Name 19-20 Personal Property by Account. 6 hours agoKentuckians will not see a rise in vehicle property taxes this year after Gov.

Property Tax The tax rate for FY 2021-2022 is 380000 cents per 100 assessed value. The average property tax rate is now 6760 compared to 6785 last year a 035 decrease statewide.

Ontario Property Tax Rates Lowest And Highest Cities

2021 Property Tax Rates For Berkshire County Berkshirerealtors

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

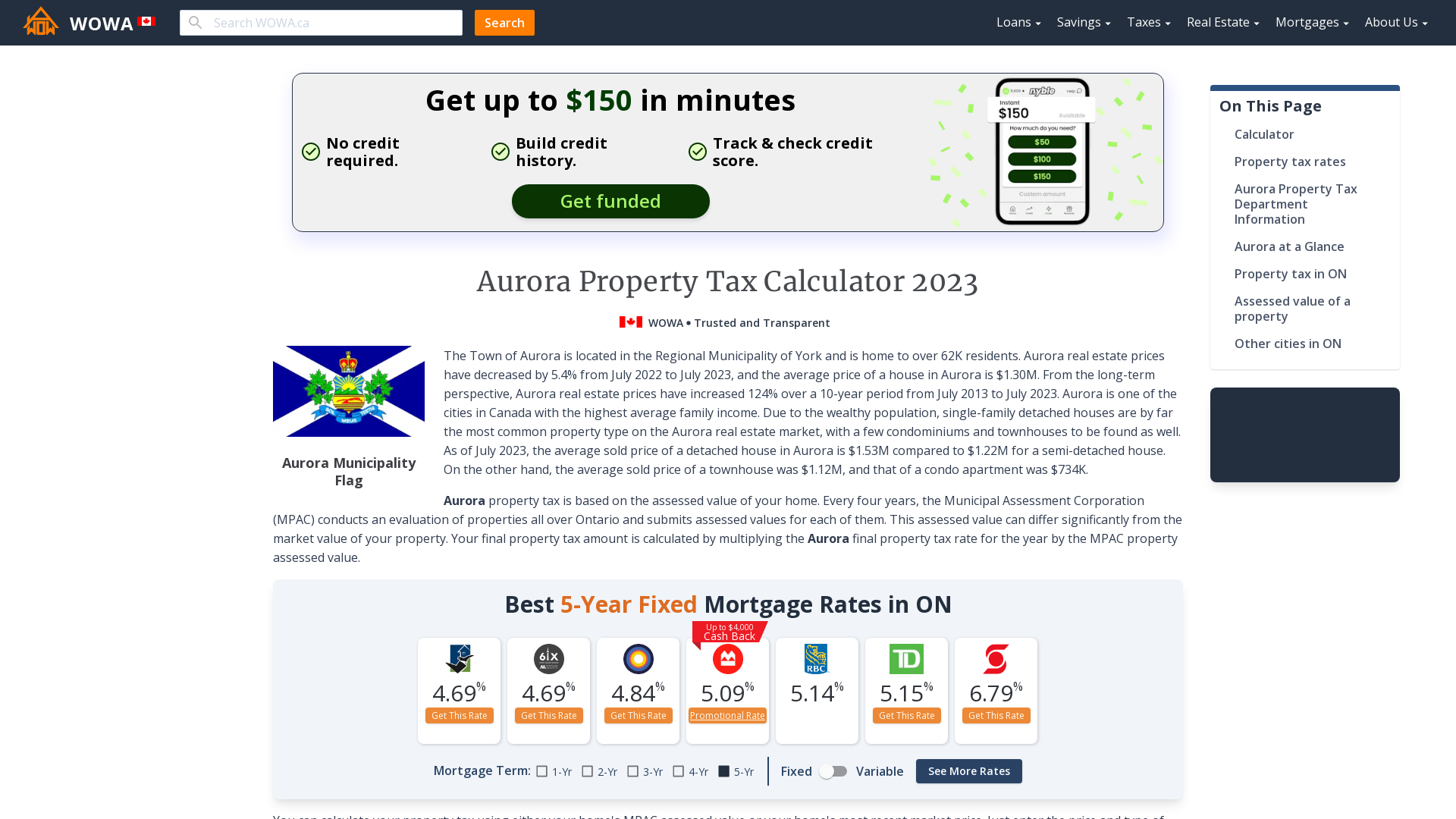

Aurora Property Tax 2021 Calculator Rates Wowa Ca

Soaring Home Values Mean Higher Property Taxes

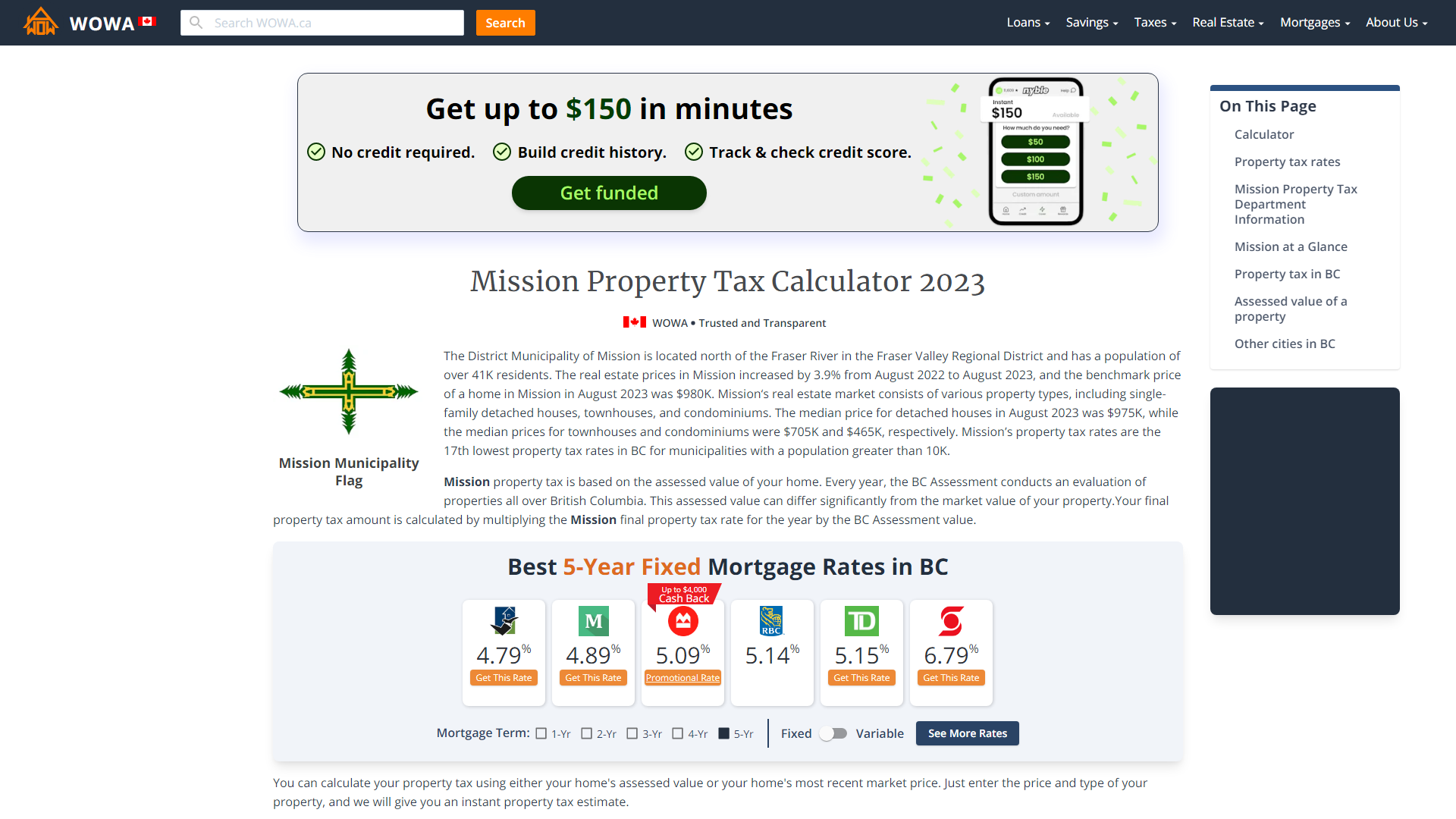

Mission Property Tax 2021 Calculator Rates Wowa Ca

Ontario Property Tax Rates Lowest And Highest Cities

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com